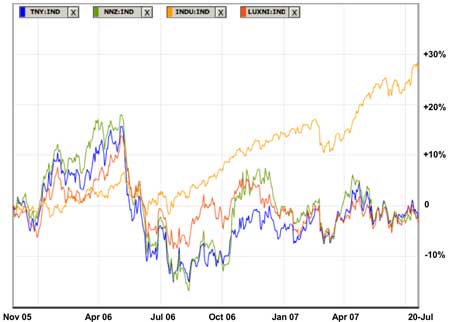

Nanowerk has an interesting analysis of nanotech public stock performance, accompanied by a fascinating graph and some close looks at some recent players. As they note,

If you have been an investor in nanotechnology companies and been lured by the promised riches, the picture doesn't look very pretty right now... and the performance gap between the Dow Jones and the nanotechnology index funds has widened significantly... Of course, individual nanotechnology stocks have done better, but then, some have done much worse. That brings us to the question: What will it take for nanotechnology, taken as a set of enabling technologies, to realize its disruptive potential and create value for nanotechnology companies? An interesting answer can be found in an analysis of the recent Unidym and Carbon Nanotechnologies merger. Growth in the sector through consolidation may enable the creation of companies with the critical mass necessary to finally get public investors really excited about nanotechnology.The graph isn't pretty. But, it's instructive to look back at the first days of earlier tech booms. The PC and software boom of the mid-to-late '80s, for example, certainly ran in similar tracks of consolidation, the search for critical mass, high fliers who crashed (Eagle, Kaypro, Osborne, Ashton-Tate...) and huge rewards for investors who bet on the right horses (Apple, Microsoft...). And the first list is much longer than the second. Why should this revolution be any different?

Just a brief recap on the performance of the nanotechnology indices. The three major exchange-quoted indexes are the ISE-CCM Nanotechnology Index (launched in late 2005; symbol $TNY), the Lux Nanotechnology Index (launched in late 2005; symbol $LUXNI), and the Merrill Lynch Nanotech Index (launched in early 2005; symbol $NNZ). We took November 2005 as the starting point (that's when TNY and LUXNI were launched) and mapped against the Dow Jones Industrial Index.

Another point: is it really advisable for investors to "[take nanotechnology] as a set of enabling technologies"? As Andrew Hargadon has deduced (see my earlier Carpe Nano post), most big advancements are recombinant in nature rather than stand-alone lightning-strikes, and even the lightning-strikes of legend were more often the result of cross-pollination than dramatic new synthesis. The lesson there is for investors to seek catalytic, market-focused opportunities rather than niche-y, technology-specific wanna-be game-changers.

Nanowerk continues:

On April 23, 2007, Carbon Nanotechnologies, Inc. (CNI), a Texas-based manufacturer of carbon nanotubes and Unidym, a developer of nanotube-based electronics in Silicon Valley, announced the merger of the two companies. The combined company, called Unidym, will be operated as a majority-owned subsidiary of Arrowhead Research.If Nanowerk is correct, then capitalism is doing its job, and that's a good thing.

"This transaction should be viewed as an important sign of the growing maturity of the nanotechnology business community" Ruben Serrato tells Nanowerk. "The pooling of investment capital, alignment of strategy and integration of materials and device production reflect a move away from early technology arrogance towards the beginning of a more sober market approach necessary for the commercialization of nanomaterials."...